How to Write option on Etrade

General Strategy

This strategy is called a Cash-Secured Put. Video Explanation: https://www.youtube.com/watch?v=9I2f8SFMRFs

Overall using this strategy, you will get paid for promising to buy a stock at a lower price in the future.

In this strategy you sell a put option, which is a contract where you promise to buy a 100 shares of a stock at a lower price (a strike price below the current market price) over a time period. On the last day (expiration), if the stock ends up going above the strike price you will automatically keep the premium. If on expiration, the stock ends up being lower than the strike price, you still get to keep your premium but you will have to buy 100 shares of the stock at the strike price you promised.

This is better than the usual strategy of setting a buy order of 100 shares of a stock at a lower price because sometimes the lower price you set doesn't hit so you get nothing! In the cash secured put strategy, if the stock doesn't hit the lower price, you get to keep a premium!

How to write a PUT option on Etrade

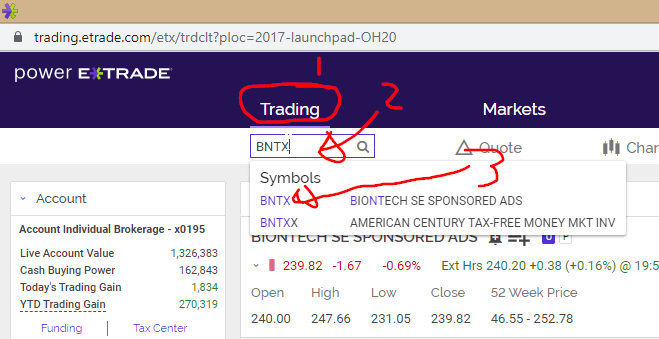

Step 1. Click trading and type you SYMBOL. Then click on the symbol.

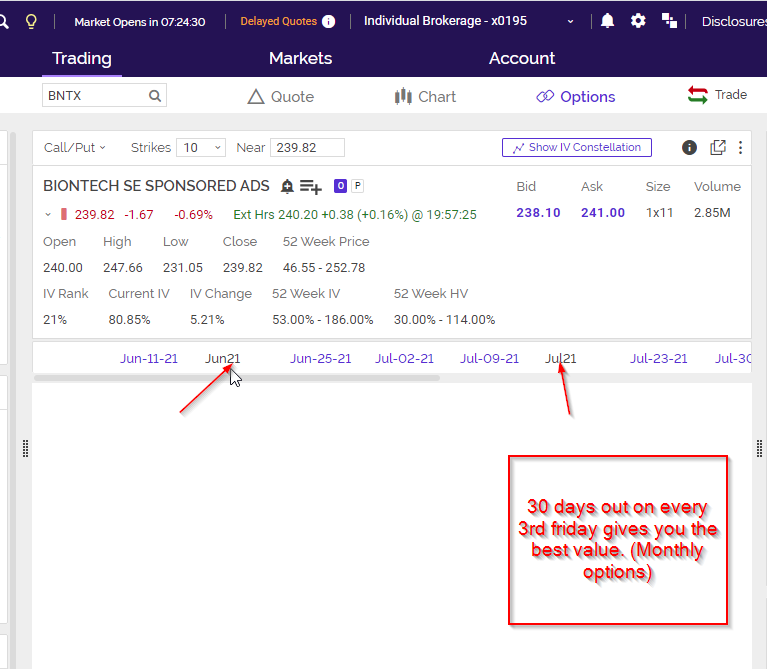

Step 2. Choose an expiration date. Usually 30 days out and on the 3rd friday of every month is most popular and best value.

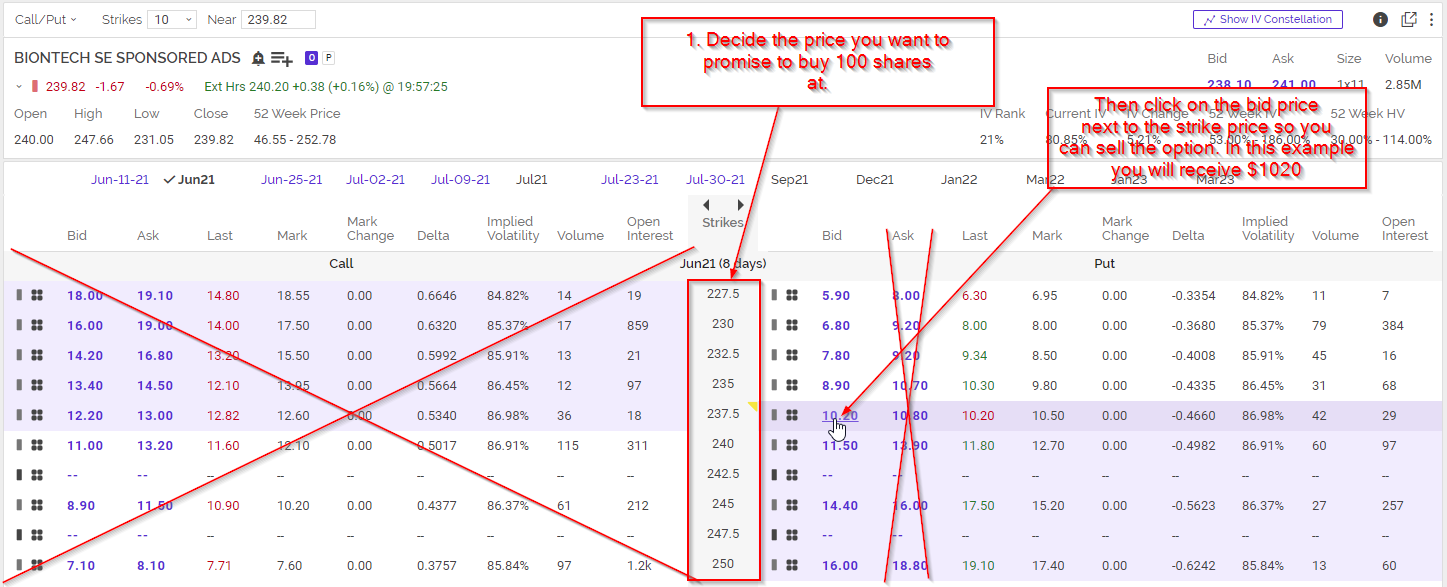

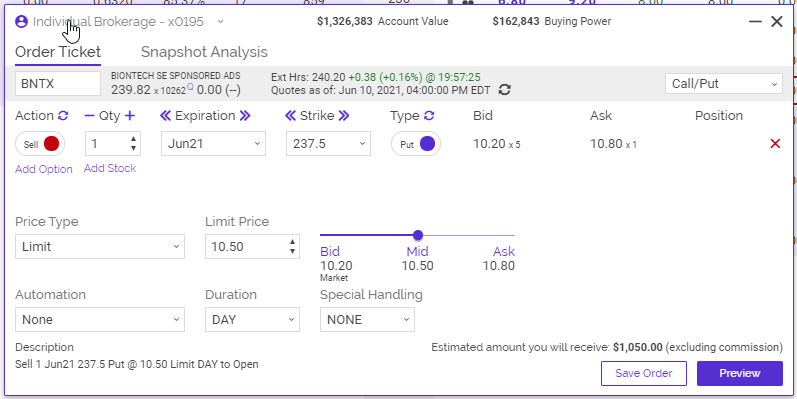

Step 3. choose a strike price (this is the price you promise to buy 100 shares of the stock at)

Then make sure you click on the bid to sell not the ask. You want to "SELL to open" do not buy to open!

As a beginner please choose a strike near or lower than the stock price. In this example BNTX is worth $239.82. So any strike price below $237.5 is a good choice. In this example, we will promise to buy 100 shares of $237.5 by June 21st. We will receive about $1050 for this trade.

How to check or cancel order?

you already know.