How to Write option on Etrade

Strategy Explained in Video Form: https://www.youtube.com/watch?v=9I2f8SFMRFs

In this strategy you sell a put option which is a contract where you promise to buy a 100 shares of a stock at a lower price (strike price below market price) over a period of time. On the final day, if the stock ends up going above the strike price you will automatically keep the premium. If on the final day, the stock ends up being lower than the strike price, you still get to keep your premium but you will have to buy 100 shares of the stock at the strike price you promised.

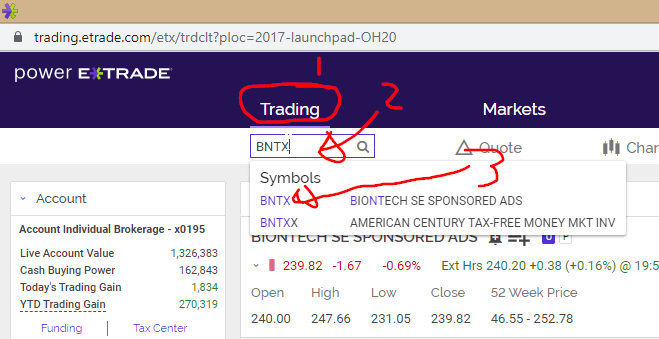

Step 1. Click trading and type you SYMBOL. Then click on the symbol.

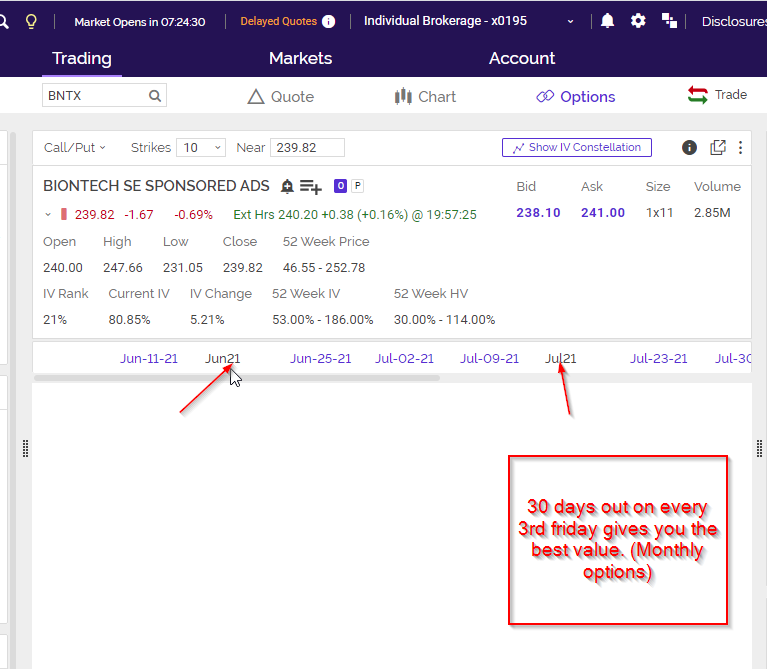

Step 2. Choose an expiration date. Usually 30 days out and on the 3rd friday of every month is most popular and best value.

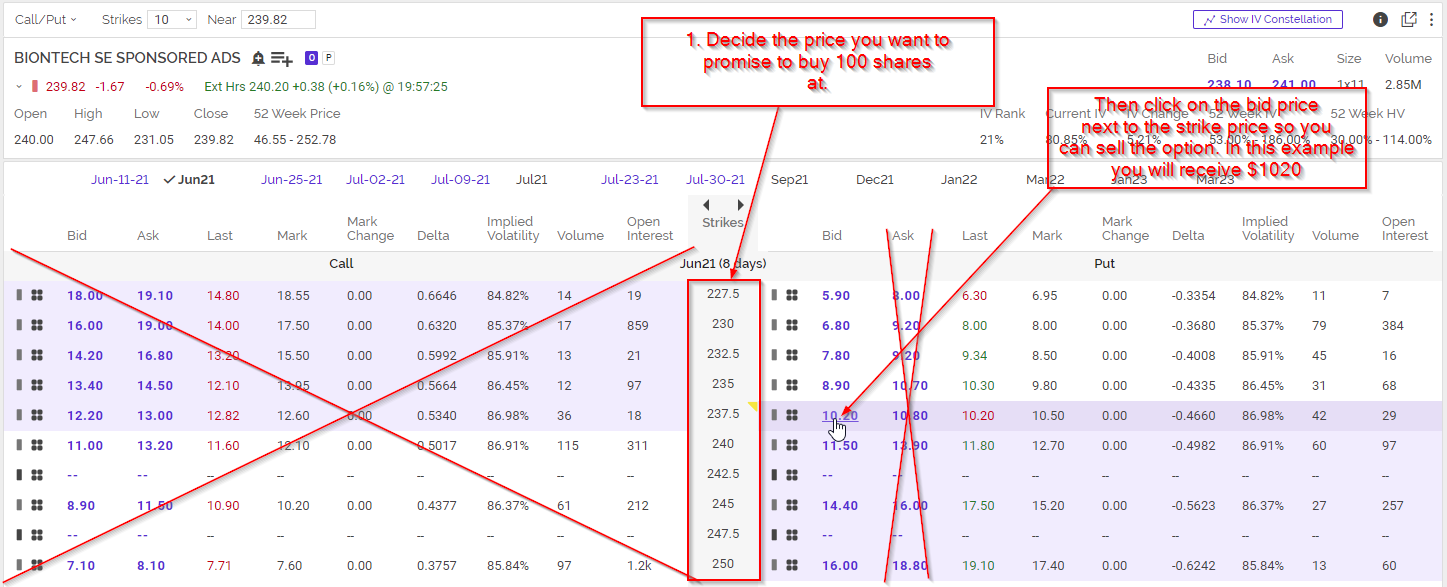

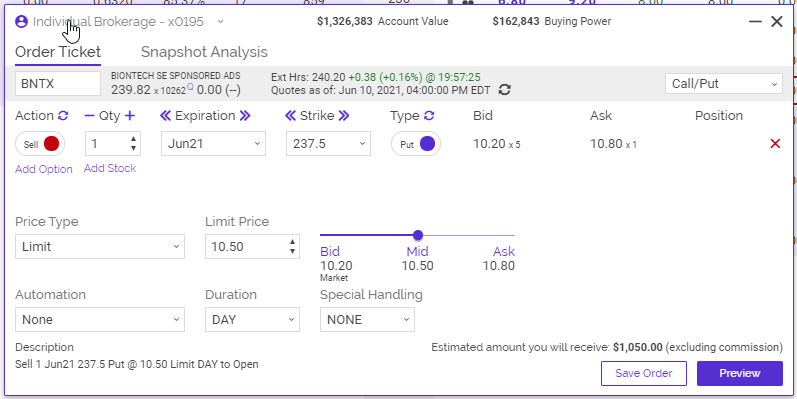

Step 3. choose a strike price (this is the price you promise to buy 100 shares of the stock at)

Then make sure you click on the bid to sell not the ask. You want to "SELL to open" do not buy to open!

As a beginner please choose a strike near or lower than the stock price. In this example BNTX is worth $239.82. So any strike price below $237.5 is a good choice. In this example, we will promise to buy 100 shares of $237.5 by June 21st. We will receive about $1050 for this trade.

How to check or cancel order?

you already know